Corporate Governance is concerned with how companies are directed and controlled. Your Board acknowledges the importance of, and is committed to maintaining high standards of corporate governance practices. We strongly believe that good corporate governance supports the delivery of our strategy and is essential to long-term sustainable growth and maintenance of shareholder value. The Board sets the tone for governance practices across the whole Group.

Our Approach

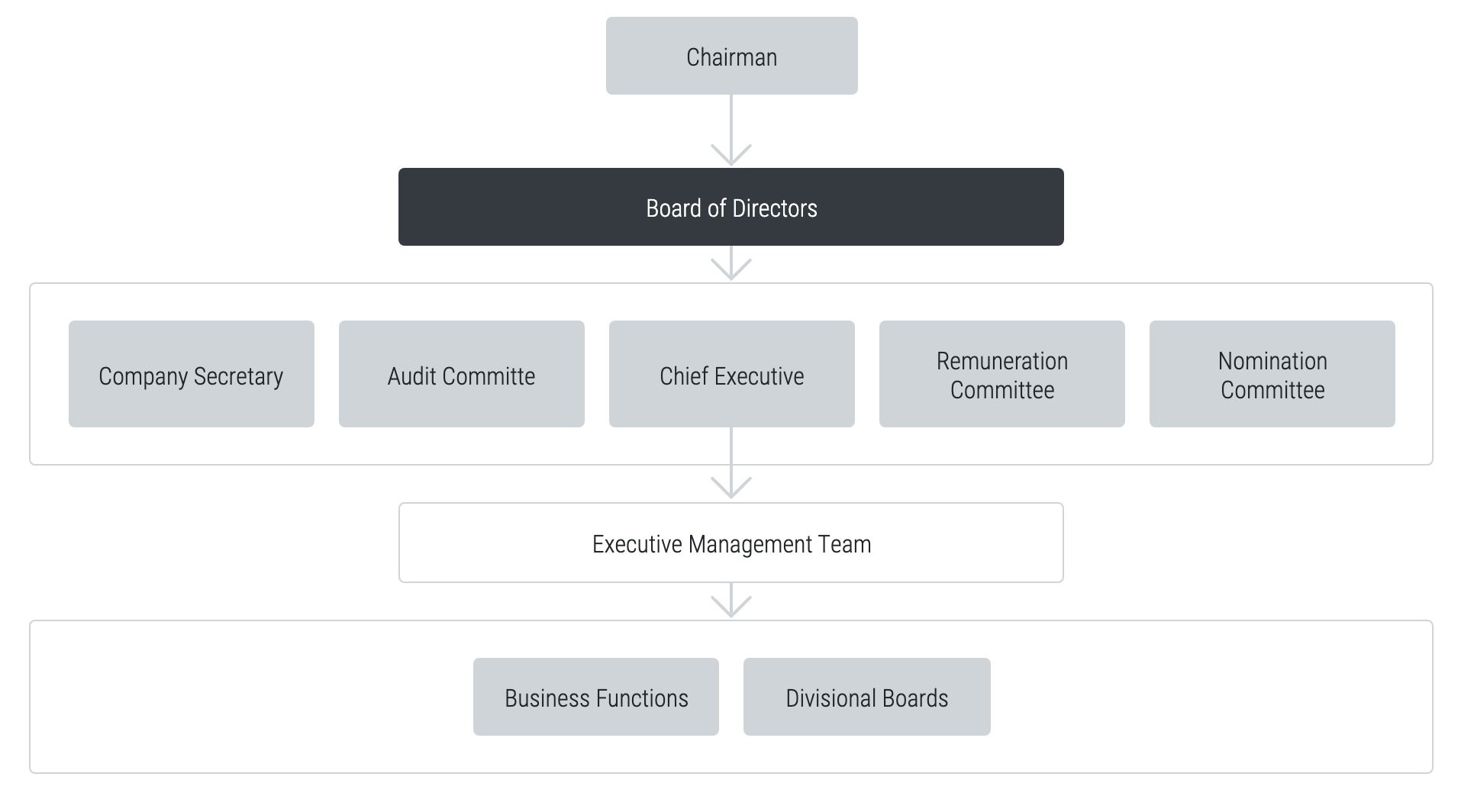

Irish Continental Group’s approach to corporate governance is explained in our Corporate Governance Report included within the 2023 Annual Report. This report also describes the roles and responsibilities of our Board and its Committees and the Group’s approach to risk management and internal control.

The main function of the Board is to provide strong strategic guidance and oversight of the performance of the Group on behalf of shareholders. The Board actively considers long term strategy and monitors and supports the work of the Group Executive Management team.

The role of the Group Chairman is to seek to ensure high quality decision-making in all areas of strategy and performance and to promote and maintain high-standards of corporate governance.

Compliance

The Group applies the principles and provisions of the UK Corporate Governance Code (July 2018) issued by the Financial Reporting Council and the Irish Corporate Governance Annex issued by Euronext Dublin.

The Corporate Governance Report included in the 2023 Annual Report explains how the Group has applied the principles and provisions set out in the code and Irish Annex.

The Corporate Governance Report is available for download by clicking the link on your right.below.

2023 Corporate Governance ReportCorporate Governance Framework